FINANCIAL PLANNING FOR CAREGIVERS

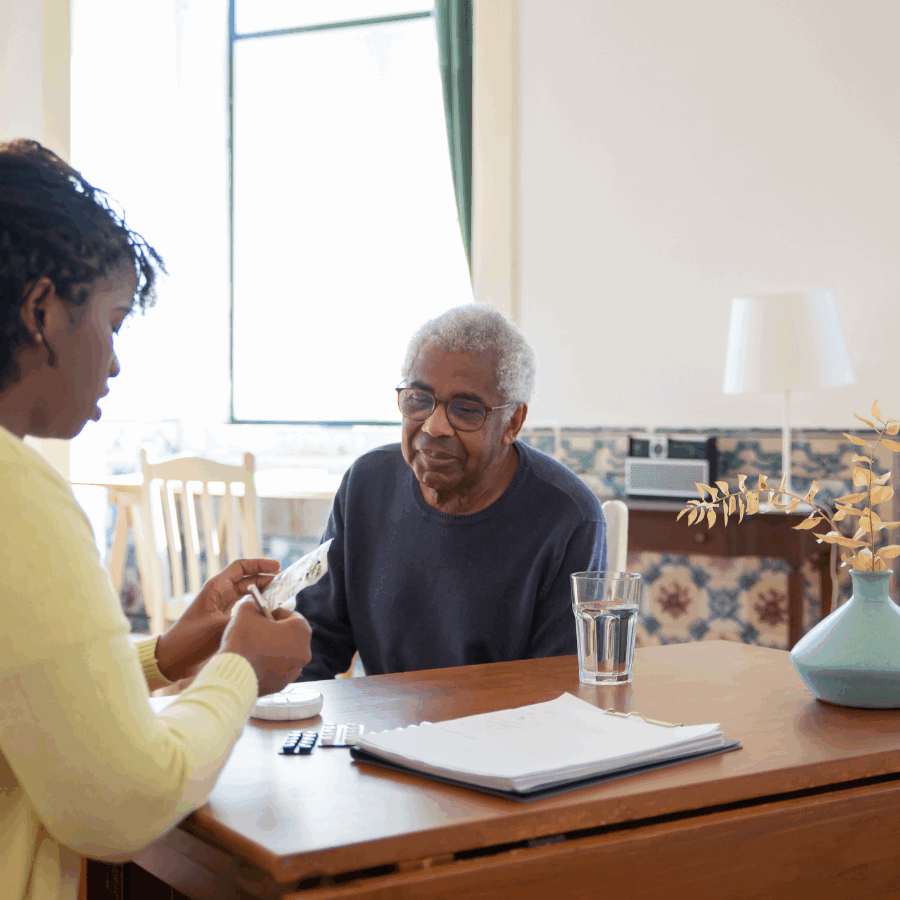

You take care of them. We’ll help you take care of everything else.

FINANCIAL PLANNING FOR CAREGIVERS

You take care of them. We’ll help you take care of everything else.

Being the financial caregiver in the family doesn’t come with instructions.

You’re the point person. The organizer. The one who steps up, figures it out, and holds it all together. But no one person can do it all, all the time…especially when things start getting complicated.

Even the most capable financial caregivers get overwhelmed trying to figure out what’s most urgent, what today’s decisions will mean down the line, or what’s around the corner.

What if you didn’t have to figure it all out on your own?

Some days, it feels like everything is on your shoulders—the bills, the paperwork, the big decisions. You’re doing your best to juggle it all while showing up with care and compassion.

You don’t have to do it alone.

Get a plan that meets today’s needs while preparing for the future

Make confident decisions without second-guessing

Trade worrying for a clear path forward & peace of mind that you’re doing the right thing

Caregiving is more than a role. It’s a full-time financial responsibility.

The cost of caregiving isn’t just emotional

it’s financial, too

The cost of caregiving isn’t just emotional it’s financial, too

0%

of family caregivers pay out-of-pocket for caregiving expenses0%

of caregivers experience workplace disruptions0%

of retirees are at risk of outliving their savings0%

of caregivers say they need more support

You need a plan that protects your loved ones

(and protects you, too).

COMPASSIONATE FINANCIAL PLANNING FOR FAMILY CAREGIVERS

You’ve got the heart for this. We’ve got the roadmap.

Caring for a loved one often means managing more than just logistics and emotions—you’re making financial decisions that affect generations. When things feel complicated, we’re here to bring clarity, confidence, and calm. Our services are designed to help you make smart, informed decisions that support your loved one now and protect your family’s future.

Estate & Legacy Planning

Put plans in writing so your loved one’s wishes are honored and your family’s not left guessing.

Long-Term Care Planning

Plan ahead for care costs with strategies that safeguard assets and stretch benefits further.

Caregiver Agreements

Clarify expectations, outline compensation, and prevent conflict with a plan everyone understands.

Caring well means planning wisely. We help you do both.

Financial Planning for Family Caregivers

At Family Legacy, we offer comprehensive financial planning for family caregivers. We know you’re not just managing numbers. You’re managing people, emotions, and major decisions.

From organizing accounts and reviewing legal documents to creating a long-term care plan that protects everyone’s future, our team walks with you every step of the way.

A dedicated financial advisor who understands the realities of caregiving

A personalized plan that supports your loved one and your future

Help organizing accounts, insurance, and legal documents

Clarity on benefits, resources, and next steps

Ongoing support as life and care needs evolve

A calm, judgment-free space to make confident decisions

We’ve walked this road, too.

At Family Legacy, we’re more than financial planners. We’re caregivers ourselves. We've been the ones staying up late sorting medical bills, navigating Medicaid forms, and wondering how to balance care with career and retirement.

That’s why our approach is different.

We provide financial planning for caregivers that’s grounded in real life—not just numbers. From building budgets and reviewing insurance to coordinating benefits and protecting family assets, we help you make smart, confident decisions at every stage of caregiving.

You won’t get a lecture. You’ll get a partner.

Someone who understands that you’re not just managing money. You’re protecting a legacy, supporting your family, and doing your best every single day.

Looking for a place to start?

free ebook

financial planning for caregivers

From managing bills to long-term care planning, the financial caregiver role is one most families aren’t prepared for. Our free guide gives you the clarity and confidence to move forward—without sacrificing your own financial future.

A Clear Financial Roadmap for Financial Caregivers

Learn how to get organized, manage cash flow, and plan long-term, without putting your own financial future at risk.

Guidance on Legal Documents, Benefits, and Protections

Know which documents you need, how to access financial support, and how to safeguard your loved one from fraud.

Practical Steps to Reduce Stress and Avoid Costly Mistakes

Get tips on communicating with family, setting boundaries, and making decisions with confidence— not overwhelm.

Want to learn with us in person?

We offer free educational workshops across the Triangle to help caregivers feel more prepared and supported. These sessions are a chance to connect with other caregivers and get guidance from professionals who understand both the emotional and financial realities of caregiving.

Financial planning for long-term care

Legal documents every caregiver should have

How to hold effective family conversations around money and caregiving